Remote payroll is the process of paying employees in different states or countries with the proper taxes, employment compliance, and specific payment methods.

Remote payroll is different from regular payroll because it requires handling tax compliance in other countries, currency exchange, and international banking regulations.

For companies that want to extend internationally or hire remotely, payroll is a big step up from simply hiring in a single country. There is no question that remote payroll is complex and it requires proper management. It needs to be handled with precision, as compliance issues can be extremely costly.

What is the Cost of Payroll Mistakes?

In research done by Alight, a study of 1,300 companies operating in at least three countries found that 67% of these organizations dealt with compliance issues that resulted in costly fines.

For companies transitioning from a local to a global operation, one must navigate:

- Constantly changing employee tax laws

- New employment agreements

- Complex payment methods

The potential cost of mistakes and fines highlights the importance of a smooth and cost-effective transition.

So, how do you pay remote employees?

The key to managing remote payroll is having an infrastructure that supports:

- ✔ Work regulation laws in different countries

- ✔ Finding the right payroll providers

- ✔ Cover exchange rates and fees

- ✔ A valid system that integrates different payroll software to avoid mistakes

With the right infrastructure, you can:

✅ Properly pay remote employees

✅ Avoid compliance issues

✅ Successfully operate a distributed team

Understanding international laws, tax structures, and compliance frameworks is necessary to navigate these difficulties and ensure efficient international payroll management.

This guide will provide you with:

- A step-by-step guide to managing remote payroll

- Key options to consider

- Audits of different global payroll providers

Let’s dive right in… 🚀.

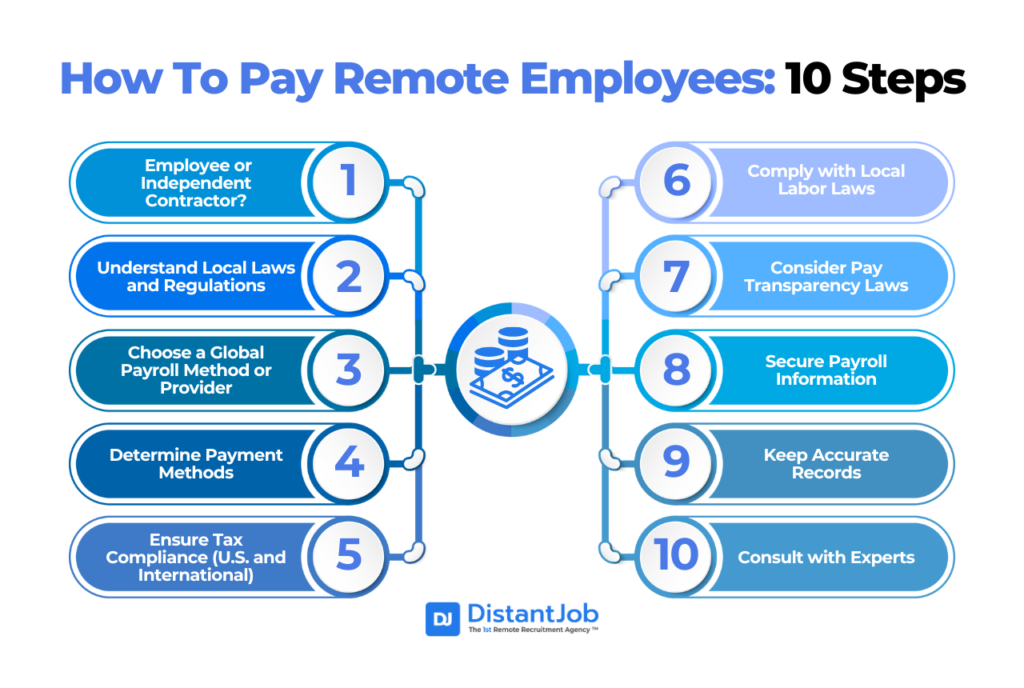

10 Steps to Pay Remote Employees

So here is how to pay your remote team, quick-and-dirty: determine your worker’s status, understand laws, get a proper global payroll solution, and consult experts. All the rest is commentary to make it right and not to step in a legal landmine.

1. Determine the worker’s status: Employee or Independent Contractor?

Proper employee classification (full-time, part-time, contractor) prevents legal and tax issues. It’s advisable to withhold and remit payroll taxes accurately, including income tax and Social Security.

For employees, you will generally have more obligations related to withholding taxes, benefits, and compliance with local employment laws.

For independent contractors, the payment process is different, and there is usually no withholding of income taxes or social security contributions. However, forms such as the W-8 BEN may be required for tax purposes in the U.S.

2. Understand Local Laws and Regulations

Each country has its own labor laws, payroll regulations, and tax obligations. These include rules on minimum wage, working hours, overtime, vacation, leave, and termination processes.

You will need to understand the tax systems of the countries where your workers are located, including income taxes, social security contributions, or national insurance.

Be aware of potential tax exemptions for foreign employers in some countries.

Check your company or payroll registration requirements in other countries.

Stay up to date on changes in laws and regulations.

3. Choose a Global Payroll Method or Provider

You could opt for a manual payroll system, but this is complex and prone to errors (often human), especially with international regulations.

Using payroll software can automate many aspects of the process, such as tax calculations, currency conversion, and compliance. Make sure the software for remote global payroll is compliant with the laws of the countries where you have employees.

No matter how many features a remote global payroll system has, it counts for nothing if it is challenging to use. Any remote payroll solution should be simple to use and intuitive. Additionally, it ought to be modified to meet the company’s specific requirements.

It is your responsibility as an employer to determine what features and payroll data insights you require from remote payroll software.

For example, will the platform be available 24/7? Will it be implemented using modern technologies and self-hosted or cloud-based so that it can be accessed from anywhere in the world? These are essential questions to ask before settling on how to pay remote employees using a global payroll solution.

Global payroll providers specialize in handling payroll in multiple countries, ensuring compliance with local laws. Some examples mentioned include Oyster, Papaya Global, ADP GlobalView Payroll, Remote, Gusto, and Playroll. Consider factors such as service availability in the required countries, industry expertise, pricing, and services offered.

An Employer of Record (EOR) can be an ideal solution if you don’t want to set up a legal entity in another country. The EOR takes on the legal responsibilities for employment, including payroll and compliance. Companies like Oyster and Remote offer EOR services. We at DistantJob do it as well.

4. Determine Payment Methods Based on their Local Currency

Discuss your preferred payment methods with your employees.

You need to look after your remote employees by ensuring they receive payments in a way that is convenient, cost-effective, and accessible. One of the most important considerations is paying them in their local currency.

Why?

✔ Avoid unnecessary exchange rate losses for your employees

✔ Reduce transaction fees associated with currency conversion

✔ Ensure faster and more accessible payments through familiar local platforms

When choosing how to pay your remote employees, consider transaction fees, exchange rates, and the availability of payment platforms in their respective countries. Some platforms charge high conversion fees, while others may have limited availability in certain regions.

Common payment options include:

💰 Bank Transfers – Reliable but can have high fees for international payments.

💳 Online Payment Platforms – Fast and widely used options like:

✔ Payoneer – Good for freelancers and international contractors.

✔ Wise (formerly TransferWise) – Low fees and competitive exchange rates.

✔ Nomad – Designed for global remote workers.

✔ PayPal – Convenient but higher fees.

By choosing the right payment method, you ensure your remote employees feel valued, paid on time, and avoid unnecessary financial stress.

5. Ensure Tax Compliance (U.S. and International)

For employees: You’ll need to accurately withhold and remit payroll taxes, including income tax and social security contributions, in accordance with local laws.

Be aware of U.S.-foreign tax treaties to avoid double taxation of Social Security.

For independent contractors: U.S. companies are generally not required to withhold taxes for foreign contractors, but a W-8 BEN form is required to certify foreign status for U.S. tax purposes.

Comply with reporting obligations in both the U.S. and the countries where your workers are located.

Consider seeking the assistance of an accountant who specializes in international taxes. This is how we do it at DistantJob.

6. Comply with Local Labor Laws

Ensure that your remote employees are compensated fairly and by local statutes, including minimum wages and overtime pay.

Be aware of rules regarding rest periods and other employee rights.

Offer benefits that comply with local regulations, such as health insurance and retirement plans if you are offering.

7. Consider Pay Transparency Laws

No, you don’t have to pay for Transparency Laws; they are called Pay Transparency Laws.

State laws differ in how they apply to remote workers. Some states, such as Colorado, Illinois, and New York, have specific guidelines for how pay transparency laws apply to remote positions. Some states, such as California and Massachusetts, impose certain salary reporting requirements on covered employers.

8. Secure Payroll Information

Strong security and privacy protocols must be implemented for remote payroll management to protect sensitive data. For example, you need an encrypted data transmission for any online payroll-related data transfer.

Strict access controls ensure that only individuals with the proper authorization can read or alter payroll data. Conducting routine security audits is essential for locating and fixing possible weaknesses in your payroll system.

For EU residents: comply with the GDPR (General Data Protection Regulation). Non-EU residents: comply with it as well.

9. Keep Accurate Records

Keep detailed records of all payroll transactions, including wages, tax withholdings, and reports filed. This is essential for compliance and audit purposes.

Regular audits are necessary to maintain payroll compliance and accuracy. Establish a regular audit schedule for payroll procedures to guarantee continued accuracy and compliance.

10. Consult with Experts

Given the complexity of international remote payroll, it is highly recommended to consult with global payroll experts, tax advisors, and HR professionals to ensure compliance and avoid costly mistakes.

We’ve been there, so that’s why, in over 15 years, we created our own payroll solution to use in our team but also with our clients.

What are the Top 5 Global Payroll Solutions in 2025?

When evaluating global payroll providers, compare not only prices but also coverage (can they pay everywhere you have or might have employees?), ease of use (demo the software interface if possible), integration options, and quality of support. The best provider for your SMB will offer a balance of affordability and features.

Global Payroll Best Practices

Click on a section to learn more.

Compliance & Regulations 🌐

Global payroll compliance is essential. Each country has unique labor laws and tax rules.

- Follow Local Tax Laws – Ensure correct tax deductions and social security contributions.

- Worker Classification – Avoid penalties by properly categorizing employees vs. contractors.

- Permanent Establishment Risk – Hiring abroad could trigger unexpected tax liabilities.

- GDPR & Data Protection – Secure sensitive payroll data across borders.

Cost Efficiency 💰

Reduce payroll processing costs while ensuring smooth payments.

- Use Low-Fee Payment Platforms – Consider Payoneer or direct bank transfers.

- Batch Payments – Minimize transaction fees by sending payments in bulk.

- Optimize Payroll Frequency – Monthly payroll can cut processing costs by 20-50%.

- Avoid Unnecessary Fees – Plan currency exchanges and transactions smartly.

Payroll Automation 🤖

Leverage payroll software to simplify processes and avoid errors.

- Automate Calculations – Ensure taxes and deductions are accurate.

- Multi-Currency Support – Use platforms that convert salaries in real-time.

- Integrate with HR & Accounting – Connect payroll to employee records and tax filings.

- Stay Updated – AI-powered platforms update compliance rules automatically.

Choosing a Payroll Provider 🌎

Select a global payroll partner that aligns with your business size and needs.

- DistantJob – A remote staffing agency that helps businesses hire top global talent with payroll support.

- Deel – Great for hiring in 150+ countries with contractor & EOR options.

- Remote – Simple, transparent pricing, ideal for small businesses.

- Papaya Global – AI-driven compliance and payroll automation.

- Rippling – An all-in-one global workforce management platform with integrated payroll and HR.

Employee Payroll Experience 🎉

Ensure smooth and stress-free payroll processing for your remote team.

- Pay On Time – Stick to a reliable payroll schedule.

- Clear Communication – Inform employees of pay dates, breakdowns, and tax info.

- Self-Service Portals – Allow employees to access pay slips and tax forms online.

- Pay in Local Currency – Avoid hidden exchange rate fees and increase employee satisfaction.

The five global payroll solutions presented – Deel, Rippling, Papaya Global, Remote, and DistantJob – offer distinct functionalities and cost structures, catering to the different needs of companies with international operations.

1. Deel:

An all-in-one platform for international payroll, hiring, and compliance. Deel lets you hire in 150+ countries either as contractors or full-time employees without worrying about local legal complexities

- It is a comprehensive global payroll, HRIS, and EOR platform.

- Ensures compliance by acting as an EOR and taking care of local taxes and labor laws.

- Supports payments for employees and contractors with various payment options and currencies.

- Has good integration capabilities with over 100 HR and accounting tools.

- It is known for its easy-to-use interface.

- Offers automation of payroll calculations and compliance tasks.

2. Rippling:

- It is a unified HR, IT, and finance platform.

- Stands out for its powerful automation, capable of automating up to 90% of HR/payroll tasks.

- Offers global payroll in over 185 countries.

- Has robust compliance, with automatic updates of laws and regulations.

- Integrates IT management, which is unique among the solutions presented.

- Its unified structure facilitates data reporting and analysis.

3. Papaya Global:

A robust cloud-based payroll solution covering 160+ countries and all worker types (employees or contractors

- Specializes in global payroll and workforce management, including EOR and contractor management.

- Emphasizes compliance, with local knowledge and legal support in over 160 countries.

- Offers detailed analytics and reports.

- Uses artificial intelligence for payroll data accuracy checks.

- Offers Agent of Record (AOR) services for contractors, managing their classification compliance.

4. Remote:

A global payroll and EOR provider known for its simplicity and transparency. Remote’s platform is often praised as “best for ease of use” among global payroll solutions.

- It is a global HR and payroll platform with broad coverage (200+ countries).

- Stands out for its integration capabilities with over 5000 applications.

- Offers a user-friendly interface and even a free HR management plan.

- Has transparent and competitive pricing.

- Offers localized benefits administration for EOR employees.

5. DistantJob:

Yes, ut’s us. We offer payroll too, on top of delivering the best global developers. We are the first remote recruitment agency focused on headhunting and managing distributed teams, especially senior software engineers for small and medium-sized businesses in the US.

- DistantJob seeks to find candidates in countries where the cost of living is lower, resulting in salaries generally around 50% of those in North America.

- There are no setup fees, hidden fees, or long-term contracts. You only pay the monthly fee, and the initial payment occurs on the first day the candidate starts working.

- DistantJob makes sure remote employees are paid on time, also offering support from the accounting team to find the most convenient payment solutions for employees.

- DistantJob handles the legal work required for contract employees.

- Beyond payroll, DistantJob offers an exceptional HR experience. This includes checking in monthly to see if employees need a raise, feel overwhelmed or unmotivated, or if their work environment makes sense. This monitoring aims to keep employees happier, more productive, and with a longer stay in the company.

- By taking care of payroll and other HR needs, DistantJob helps reduce the costs and time associated with employee turnover, increasing talent retention.

- DistantJob makes it easy to offer bonuses and raises by transferring the amounts set by the client to the employees. DistantJob can also, with permission, remind customers about the appropriate time to offer a raise.

- DistantJob tries to adapt to the client’s time off policy and takes care of calculating days off.

- Case studies demonstrate that DistantJob offers proactive support in a variety of situations, such as personal issues that affect performance, deceases, and even delicate processes such as mass layoffs.

In summary, Remote and Deel tend to be more affordable and transparent in terms of costs, especially for smaller companies, with Remote even offering a free HR plan. Papaya Global and Rippling are generally considered premium options, with Papaya becoming more cost-effective at a larger scale and Rippling offering a broader set of integrated functionalities.

However, DistantJob positions itself as the best option for both employee management and global payroll solution, bringing the salary cost down to 50% and just a monthly fee, with no hidden fees, setups, or fine lines. DistantJob’s functionalities range from comprehensive HR solutions to payroll, compliance, remote work management, support in complex situations, and talent retention.

Best Practices for Remote Payroll Management Systems

Managing global payroll is challenging, but with the right approach, SMBs can pay remote employees accurately, on time, and in compliance with local laws.

You must implement best practices in payroll management. To ensure accuracy and compliance while enhancing the employees’ working environment.

Here are key best practices to follow:

1️⃣ Stay Compliant with Local Regulations

✅ Register for local payroll taxes and comply with country-specific tax laws.

✅ Classify workers correctly (employee vs. contractor) to avoid legal issues.

✅ Be aware of Permanent Establishment Risks (corporate tax liabilities in foreign countries).

✅ Ensure GDPR & data protection compliance when handling employee payroll info.

2️⃣ Optimize Costs & Reduce Payroll Expenses 💰

✅ Use cost-effective payment platforms (Payoneer, Deel, Remote, etc.) to reduce fees.

✅ Batch payments to minimize transaction costs.

✅ Pay employees in local currency to prevent conversion losses.

✅ Stick to monthly payroll where possible (reduces processing fees by up to 50%).

3️⃣ Improve Employee Payroll Experience 🎉

✅ Pay on time, every time – delays hurt employee trust.

✅ Be transparent about payroll policies, taxes, and deductions.

✅ Offer self-service portals so employees can access pay slips and tax forms.

✅ Pay in local currency and cover exchange fees to maximize take-home pay.

4️⃣Maintain Strict Access Controls 🔐

✅ Restrict payroll data access to authorized personnel only.

✅ Conduct routine security audits to identify and fix potential vulnerabilities.

✅ Use multi-factor authentication (MFA) to protect payroll systems.

✅ Encrypt sensitive payroll information to prevent data breaches.

Conclusion

The future of remote work is now in our hands — it’s up to you to develop the strategy that will help your business adapt for years to come. As a future-oriented business, it’s upon you to adopt a modern approach to payroll management for your remote teams.

Adopting a robust system for remote payroll management will help you not only meet your responsibility toward your employees but also provide a platform for continued corporate growth.

Engaged and satisfied remote workers are also more likely to be dedicated employees who exhibit loyalty—which fosters productivity and significantly contributes to company growth.

But maybe this is too much for you. Maybe that is a large chunk of information, and even if you get it, you may feel uncomfortable trying it yourself.

That is perfectly fine. When I had my first international business almost twenty years ago, I felt that way as well, but I got it eventually.

And I could do it for you. That is something we do regularly for those we work with.

Why don’t you let me do it for you?

We at DistantJob resolve many challenges most businesses encounter in managing remote payrolls. We take on these pesky administrative tasks that keep you from achieving your core business goals, employing a solid understanding of global regulations and compliance.

Get in touch today, and let’s help you handle your remote payroll.