The AI bubble is a rapid escalation of stock prices from LLM companies driven by both speculation and expectation. It’s a cycle of displacement, boom, euphoria, profit taking, and ultimately, panic.

But for a tech leader and as a hiring manager, the question isn’t just about stock prices; it’s about the stability of your infrastructure. Your concern is the safety of these SaaS providers. What happens to these companies when the bubble bursts? Will their service that you rely on completely disappear? Will these services, which are not owned in-house and often still charge a fortune for API connectivity, become drastically more expensive?

It’s a scenario that has drawn direct comparisons to the dot-com era, leading many to ask: Is this speculative growth justified by the underlying technology, or is the market running ahead of itself? To understand the risks, we must first clearly define the technology at the heart of the frenzy and identify how much of it is a fad.

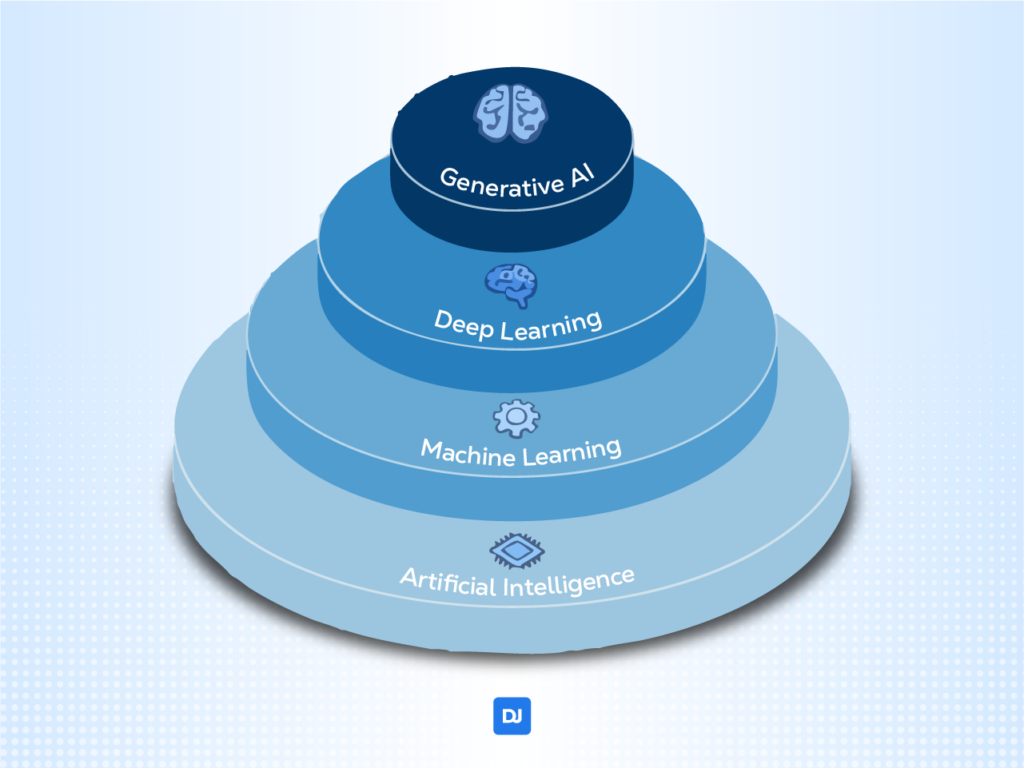

What is an AI?

Artificial Intelligence (AI) is a broad field of computer science focused on creating machines that can perform tasks that typically require human intelligence.

AI isn’t a single technology, but an umbrella term for many related areas. Some of the most common are:

| Concept | What It Is | Real-World Example |

| Machine Learning (ML) | A type of AI where systems learn directly from data to make predictions or decisions. | Email spam filters that learn what messages to block. |

| Deep Learning (DL) | A subfield of ML that uses complex structures called neural networks (inspired by the human brain) to handle very complex data tasks. | Facial recognition on your smartphone. |

| Natural Language Processing (NLP) | The branch that enables computers to understand, interpret, and generate human language. | Voice assistants like Siri or Alexa, or language translation tools. |

| Generative AI | A type of AI (often using Deep Learning) that can generate new, original content, such as text, images, or code. | AI chatbots or tools that create art from a text prompt. |

Which AI bubble is about to burst?

The debate surrounding the bubble focuses on where disproportionate valuation growth is occurring, usually linked to a narrative of future exponential growth and disruptive adoption. According to Goldman Sachs CEO David Solomon, “a lot of capital that was deployed that [doesn’t] deliver returns.” Jeff Bezos also calls the moment “kind of an industrial bubble.” Sam Altman, CEO of OpenAI and one of the biggest AI enthusiasts, said that “people will overinvest and lose money.” Finally, Sundar Pichai, CEO of Google, said Google wasn’t immune.

| IA Market Branch | AI Bubble Risk | Reason |

| LLMs and Generative AI | High | These are the technologies that have attracted the largest volume of venture capital and inflated startup valuations, promising to reshape all sectors. |

| Semiconductors, Chips, and GPUs | High | The demand for GPUs to train and run LLMs has exploded, leading to record valuations (e.g., Nvidia). The price of these assets is directly linked to the continued success of Generative AI. |

| Deep Learning Infrastructure and Platforms | Medium-High | Companies that provide the cloud infrastructure and specialized tools for the generative AI boom. |

| Classic Machine Learning Recommendation Systems, Optimization | Low | These branches are considered Mature AI. They are already integrated and monetized within established business models (e.g., banking, e-commerce, logistics). Their value growth is more organic and stable, not speculative. |

| Robotics, Operational Research | Low | Although they use AI, Robotics is a sector with hardware and logistical challenges that limit the speed of purely software-based speculation. Operations Research and Optimization are mature disciplines with known returns on investment. |

| Deep Learning Pre-LLM, Scientific Models | Low | These are highly specialized sectors that do not generate the same kind of mass investment enthusiasm as consumer and corporate generative AI tools. |

Why Is Mature AI Left Out?

The AI sectors previously mentioned (classic ML, Optimization, etc.) are typically low-risk businesses with stable returns for a few reasons.

First, these technologies are not new. They have proven their value over decades and are an essential part of companies that already have predictable revenue streams and solid business models.

Moreover, the value that a recommendation system (such as a video recommendation system on YouTube) adds to a company is generally quantifiable and predictable. This contrasts with the uncertain and speculative value of a new Generative AI application that is still seeking a sustainable business model.

Investment in these AI areas is more focused on operational efficiency and continuous improvement, not on betting on disruptive technology or a speculative “gold rush.”

Essentially, the concern about the bubble lies in the excess capital injected into future promises (Generative AI) relative to proven present value (“Mature” AI).

AI Bubble Criticism

Many analysts and even industry leaders have acknowledged the speculative nature of the current situation. Sam Altman, CEO of OpenAI, admitted that “When bubbles happen, smart people get overexcited about a kernel of truth”. He even compared the situation to the dot-com bubble, between March 2000 and October 2002, when the NASDAQ lost almost 80% of its value. Most internet companies at that time were just PowerPoint presentations in HTML.

Bubble Signals and Concerns

Criticism of the ‘AI Bubble’ encompasses a wide range of signs and concerns, ranging from financial instability and overvaluation of companies to architectural flaws.

1. AI Companies are Roundtripping

The core of the AI bubble concern lies in the intricate web of financial deals between major tech players, including Nvidia, OpenAI, Microsoft, AMD, and Oracle, among others.

For example, a company like Nvidia (a chip manufacturer) invests in a customer like OpenAI (an AI development firm). OpenAI then uses that capital to purchase chips and services from Nvidia and other hardware providers (like AMD and Oracle), who in turn may also hold stakes in OpenAI or its cloud partners.

In some cases, chipmakers offer “vendor financing” or credit to their customers, facilitating large hardware purchases and making it easier for loss-making AI startups to acquire the necessary infrastructure.

This creates a cycle where money flows from investor to customer and back to the vendor, generating large “projected revenues” and high valuations without a proven, profitable end market for the AI services themselves.

According to Julien Garran from MacroStrategy Partnership:

“[…]this is the biggest and most dangerous bubble the world has ever seen. The misallocation of capital in the US (which also includes housing, VC, and crypto) is already 17x the Dotcom bubble and 4x the 2008 real estate bubble, and, as it unwinds it will not just threaten significant economic malaise, it will threaten to overturn the entire globalist agenda, that developed with the advent of Thatcher and Reagan in from 1979 and 1982, accelerated with the fall of the Berlin Wall in 1988, and sped up again with China’s accession into the WTO in 2002.”

Not everyone agrees that the situation is a bubble poised to burst. Some argue that the underlying technology is genuinely revolutionary and transformative. The question is: how revolutionary must it be to justify the investment?

2. High Operational Costs

Currently, there is no business model to run an LLM that can be profitably executed in the short or medium term. OpenAI’s operational costs are around $11.5 billion per quarter, according to analysts analyzing Microsoft reports.

If OpenAI were a car engine, the $11.5 billion quarterly loss would indicate that, although the car is moving at the speed of light (impressing the market), it is consuming fuel at a rate 100 times the designed rate. The fuel (Microsoft’s funding) is nearly empty. The problem is not the lack of speed (the technology), but the engine’s inefficiency makes the journey financially unsustainable.

3. Lack of Significant Return on Investment

An MIT report (Gen AI Divide) revealed that 95% of companies’ generative AI pilot projects are failing to deliver any Return on Investment (ROI). In contrast, the few companies that are actually seeing results are not trying to automate their entire business; instead, they choose a single tedious but valuable task, such as back-office bureaucracy, and quietly make it faster.

4. Market Saturation

The AI bubble’s investment saturation is the expectation that the massive wave of spending by Big Tech companies is about to subside. According to Fortune, analysts at Goldman Sachs expect AI spending “in 4Q 2025 and 2026”.

AI optimism in the stock market is concentrated in about 10 Big Tech companies (including Nvidia, Microsoft, Amazon, and Meta). According to the Los Angeles Times, these companies are forecast to spend up to $344 billion on AI in 2025. They accumulated so much capital in AI, which Goldman Sachs predicts will decrease. If the analysts are right, the hype driving these stock prices will likely fall.

5. Lack of Infrastructure

Is the US ready to accommodate AI electric bills? According to Reuters, America’s largest power grid is struggling to meet AI demands. A Bloomberg report says “more than three-quarters of highly-distorted power readings across the country are within 50 miles of significant data center activity”. If AI is the future, it’s not sustainable or scalable so far, and many people will suffer an outage.

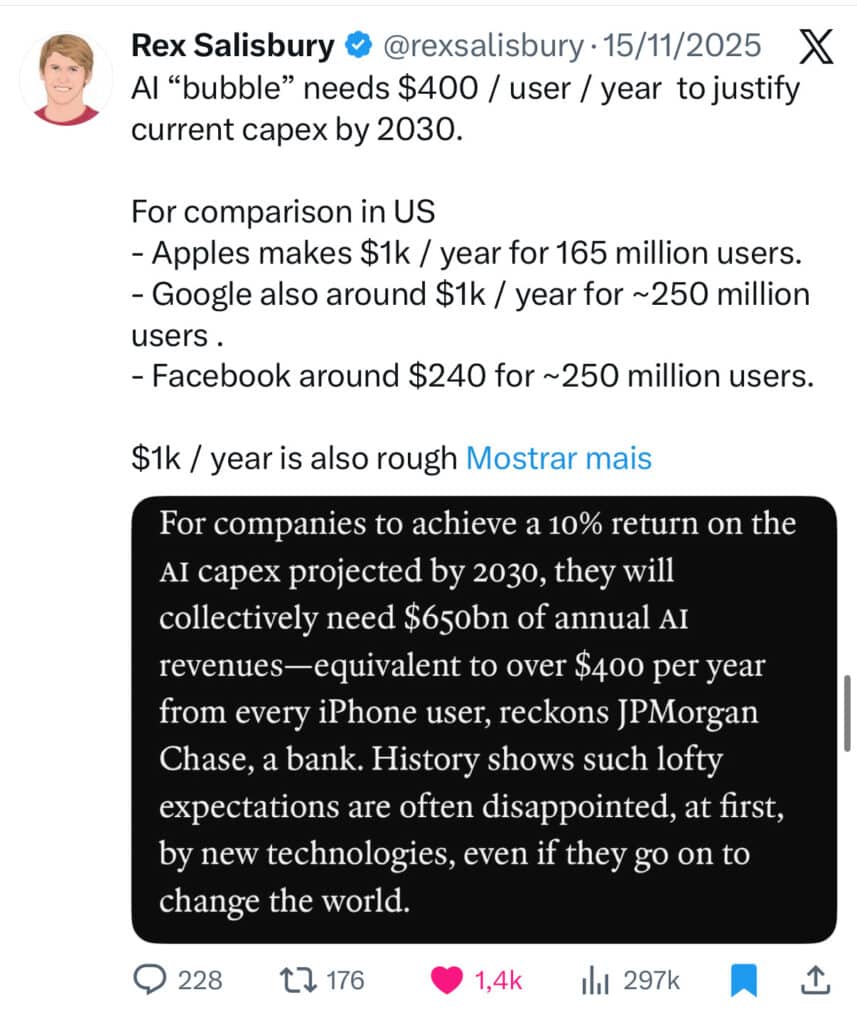

How Much Money Does the AI Market Need to Earn to Avoid a Bubble Burst?

To justify current capex, the AI Market must earn an average of $400 per user per year, according to Rex Salisbury. Considering that Google and Apple earn over $1000 per user per year, we are expecting that a whole emerging market earns, on average 40% as much as a Big Tech company.

Rex Salisbury’s insight comes from the bank JP Morgan, which added that “to drive a 10% return on our modeled AI investments through 2030 would require ~$650 billion of annual revenue into perpetuity… which equates to $34.72/month from every current iPhone user”.

In other words, the new economic value generated by AI has to be enormous to justify the cost of construction. Or it will be a huge success or a catastrophic bubble burst. There is no middle ground.

AI Bubble Job Market Shift

While nearly one in five Gen Zers are afraid to be replaced by AI (Fortune), and 71% of Americans fear permanent worker displacement (Reuters), experts doubt AI will replace workers completely.

For instance, Goldman Sachs states, “technology change tends to boost demand for workers in new occupations (…) Approximately 60% of US workers today are in occupations that didn’t exist in 1940, implying that more than 85% of employment growth since then has been from technology-driven job creation.” In other words, Goldman Sachs believes AI will bring demand for workers who know how to use it. They believe AI “could displace 6-7% of the US workforce if AI is widely adopted”.

Meanwhile, the World Economic Forum says AI puts 9 million jobs globally at risk, but it compensates by creating 11 million new positions. It results in a net gain in the employment balance. The challenge, however, is ensuring that displaced workers can relocate and acquire the new skills needed for the jobs created.

What about Developers?

Developers’ jobs are not in danger. In fact, developers use AI more than most. GitHub research from 2023 found that 92% of developers use AI in some part of their workflows. This data is supported by another study from Anthropic, which says “AI use is more prevalent for tasks associated with mid-to-high wage occupations like computer programmers and data scientists”.

Since Devs are the AI’s biggest customer, they are unlikely to be replaced anytime soon. In a recent generative AI pilot at Adidas, developer productivity increased by 20% to 30% in teams. This gain was measured through metrics like increased commits, pull requests, and overall feature delivery speed.

That being said, according to other studies, development productivity doesn’t seem to be improving with AI’s guidance. A “meter study” from Model Evaluation & Threat Research (METR) revealed that, although developers believed AI-powered code completion made them 20% faster, actual measurement showed it slowed them down by 19%. Worth noting that the participants were experienced developers, with an average of over 10 years of experience, working on projects they were very familiar with.

Why do these studies conflict with each other? Some say that developers report time gains, and others say that’s all smoke and mirrors, and AI is wasting their time.

That suggests AI is best at automating repetitive tasks. The cognitive effort required to verify and correct the code generated by vibe coding consumes more time than the promised savings.

The use of AI is valid, but it must be done with the awareness that errors are likely to exist, requiring the developer to know how to identify and test for these flaws. The programmer must continue to learn and improve, not delegating complex tasks to AI.

AI cannot replace programmers at all. Lovable is an amazing tool; integration with Supabase makes it even more interesting, but these tools cannot replace the actual human workforce. A recommendation is not to ditch AI, but replace the AI-first attitude with a people-first culture.

AI Bubble Bursts: What Else Might Happen?

The bubble is expected to burst when returns cease to justify the risk. While the bursting doesn’t mean the death of AI technology, it will bring severe consequences and a “recalibration” of the landscape.

Potential Losses On the Stock Market

The enormous expected revenue that justifies companies’ high valuations would evaporate. AI hype stocks would drag down indices, potentially collapsing broader technology valuations and even companies that claim to use AI over all their workflows. The systemic risk of this “mania” is already a cause for concern for financial institutions such as the Bank of England and the IMF.

Market Shift

If the AI Bubble bursts, surviving companies would need to undergo a market shift. They would need to restructure and focus on security, compliance, or infrastructure, rather than AI. This recalibration will ensure that the winners are those built on defensible value, solid unit economies, and real adoption.

Many startups with a weak basis, driven by ambition rather than revenue, would run out of cash and fail, leading to more mass layoffs and the dismantling of teams.

The collapse could lead to a more stringent regulatory reaction. Governments could crack down on data privacy issues, misuse, and monopolistic behavior by AI companies. Distrust in information would be amplified, as AI-generated content is already saturating the internet with fake news.

How to Protect Your Company

To survive an AI bubble burst, your company should focus on practical applications with clear return on investment (ROI), build diversified and resilient systems, and invest in fundamental human skills rather than chasing hype. The long-term survivors will be those who use AI as a tool to solve real problems, not as the entire business model itself. Here are some types to deal with this potentially dangerous landscape.

Conduct an audit of AI tools

Evaluate every AI tool to determine if it improves business metrics. Cut tools that do not provide a clear, measurable ROI.

Diversify your systems

Avoid vendor lock-in by building redundancy into your tech stack. If one AI vendor shuts down or raises prices, you don’t want your entire operation to collapse.

Build an operational capability

Focus on integrating AI into your core operations to build better workflows. Avoid fancy-schmancy LLMs that “everyone is using, therefore it seems good enough”.

Focus on fundamentals and profitability

When the hype fades, businesses with a clear path to profitability and sound business models will survive. Avoid vague “AI-powered” claims and concentrate on delivering value.

Slash burn rates and manage cash flow

Startups, in particular, should cut unnecessary spending and extend their financial runway to weather a potential downturn.

Focus on “Human-in-the-Loop”

Instead of laying off your workforce and giving AI full control of their tasks, hire the best global talent. Humans don’t hallucinate (often, I mean), they are not limited by programming scope, and they think outside the box. Humans created AI, after all. Instead of hoping AI can replace your team, use it to augment them. The most resilient companies are hiring talent who understand the math, rather than just prompt engineers who understand the hype.

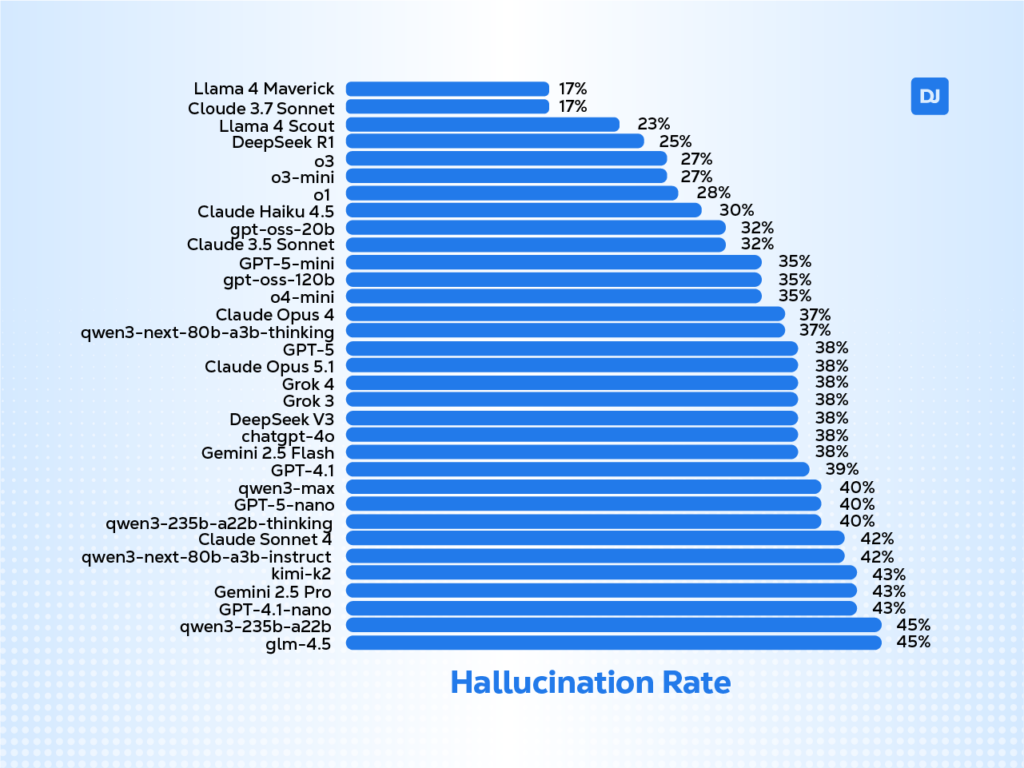

AIMultiple made a chart with a Hallucination rate comparison:

Utilize the Best AI Tools Suited for Your Business

Cut tools without measurable ROI and invest that budget into senior talent who can solve complex problems that AI currently cannot.

If you have the means, hire a Data Scientist or a Machine Learning Engineer to build an AI/ML tool and scale it out, rather than relying on AI behind a vendor lock-in. AI is a good tool, but that’s it: a tool, not a means to an end or the end itself.

Conclusion: Don’t Rent the Hype, Hire the Talent

An AI Bubble does not mean AI isn’t revolutionary; it means the revolution will unfold over years rather than overnight. If history is a guide, after the hype comes a shakeout. Weaker players crumble, and there could be an “AI winter” in certain areas if expectations recalibrate.

However, the core of AI is advancing steadily, and the strong players (both companies and technologies) are likely to persist. They will define the next era of innovation. The companies that survive will be those that rely on solid engineering principles, not just on API calls.

If you are ready to build a defensible, proprietary AI strategy, you need the right people. You don’t need a chatbot; you need a Data Scientist or a Machine Learning expert to build your own AI model.

DistantJob specializes in finding these exact experts. We don’t just find resumes; we headhunt senior remote talent that integrates seamlessly into your team! Every hard skill and soft skill you want in two weeks, and you only pay when you actually approve the candidate.

Contact us! Don’t get stuck with a failing AI, get the employee of your dreams today!